Welcome to our Website

Welcome to our Website

Mutual funds are created when several people who wish to earn wealth (investors) combine their resources to create a huge investable amount (corpus). This large corpus is then invested into various companies across industries, operating in different sectors of the economy - depending on the type of fund chosen. All the investors of a mutual fund share in its profits, losses, incomes, and expenses in direct proportion to their level of investment.

Companies that create mutual fund schemes are called Fund Houses or Asset Management Companies (AMCs). The professionals who study the markets and pick companies to invest in are called Fund Managers. Fund managers spend a great deal of time analysing markets and studying different sectors of the economy to figure out which companies are most likely to turn a profit - in different time frames - and choose the best option.

There are thousands of mutual funds in India, under different categories, offered by hundreds of AMCs and Fund Houses. For fairness and transparency, global agencies exist that analyse and rate the performance of funds over time and make sure that investors are well informed before investing. It is mandatory for AMCs to declare a standard against which the performance of any given fund can be measured - this is called a benchmark. There are also regulatory bodies like AMFI and SEBI that ensure no investor ever gets scammed.

Mutual funds allow individuals to make their money work for them - meaning that they do not need to actively perform tasks for monetary gain. Any amount invested in mutual funds will either grow or shrink depending on market performance and the skill of the fund manager.

There are thousands of mutual funds in India handling thousands of crores of Rupees.

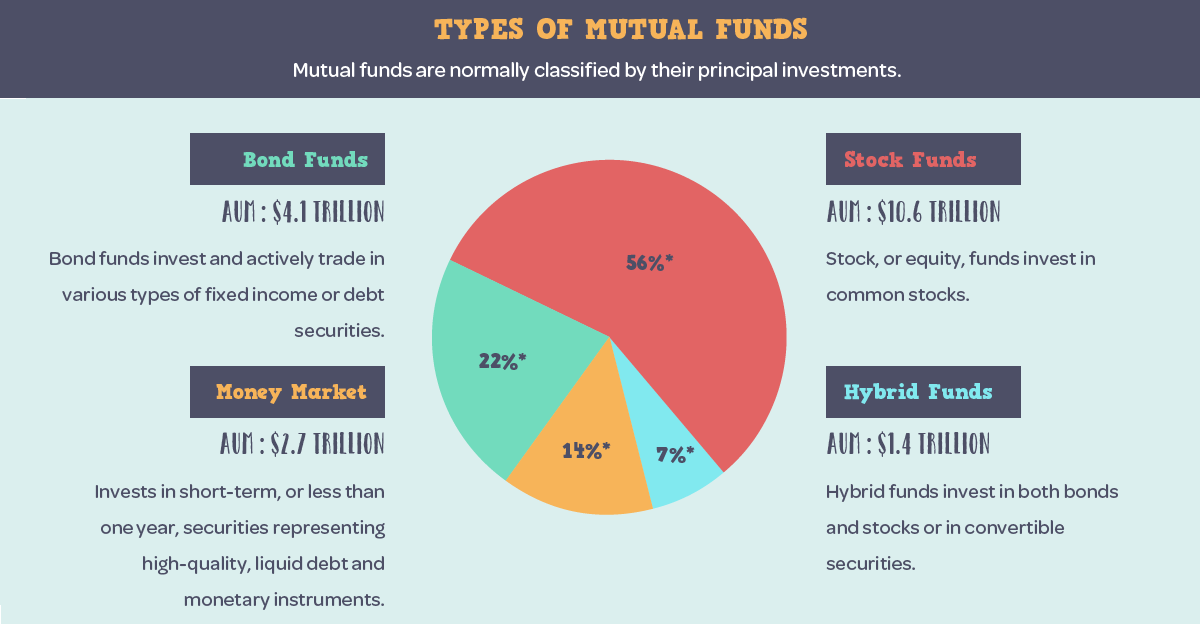

Mutual funds are an investment tool that pools money from several investors and invests it in company stocks, bonds, government instruments, etc. in order to generate a profit for investors. This profit may be paid out as dividends to investors (dividend plans) or reinvested by the fund for capital appreciation (growth plan), There are many different types of mutual funds based on various characteristic differences. Most mutual funds try to diversify their investments into as many different companies and industries as possible, and some invest in only specific industries and sectors of the economy. Some funds aim for high-risk-high-reward strategies, while some opt for low-risk-regular-income strategies. There’s a huge variety of funds to choose from, and a large number of Asset Management Companies (AMCs)/fund houses. that offer excellent schemes for all types of investors. Some banks and financial distributors also sell mutual funds.

Different types of mutual funds operate slightly differently from one another, but they all have some basic principles on which they operate that define them as mutual funds.

The most basic way in which mutual funds operate is explained below:

1. An asset management company (AMC)/fund house identifies a potential earning possibility in the market and calculates the risk and potential reward involved in this particular investment.

2. The AMC studies other related investment opportunities that could boost the value of - or ensure the success of - the main opportunity.

3. The fund manager working for the AMC picks and chooses different investments in order to balance out the risk and total earning potential - balancing the right high risk-high reward equities with high safety-relatively consistent income securities.

4. All the details about the fund including risk factors are well documented and presented to the industry body SEBI for regulatory approval and to the public for consideration.

5. The fund scheme is made available to the public, who then buy into the fund by purchasing fund units. The more fund units are purchased, the larger the investment, and thus the greater the proportion of potential income.

6. The investments are made and, depending on the fund’s structure, the fund will either be passively or actively managed by a fund manager.

7. Under the dividend option, declared dividends are proportionally distributed amongst investors. Under the growth option, dividends are reinvested for capital appreciation.

8. At the end of the fund’s tenure, capital gains are paid out to the investors.

+91 9328170316

6, Darji Society, Nr. Mandav Chokdi,

Opp.Anaj Market,

Dahod -389151

Gujarat

Privacy Policy | Copyright © Start Your SIP. All rights reserved. | Designed & Developed By : www.anchoredge.in